tax on forex trading ireland

You should consider whether you understand how CFDs work and whether you can afford to. Tax On Forex Trading Ireland.

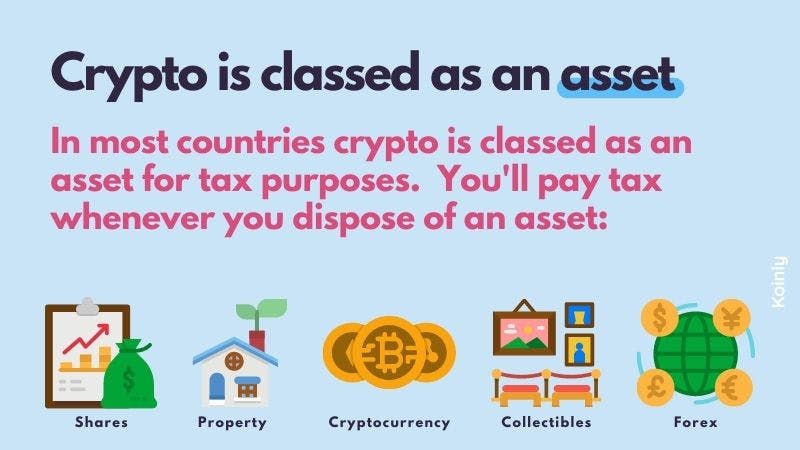

Crypto Tax Free Countries 2022 Koinly

The highest capital gains tax in the region is Denmark where the rate is at 42 percent.

. Central Bank of Ireland CBI is the primary regulator overseeing the Irish financial sector. Tax on forex trading in ireland. You can choose between two products.

Income Tax rates are currently 20 and 40. He had bought them for 4500. If Fo rex business becomes your main source of income the currency trading tax ramifications are different.

IM Academy Forex Trading was started as a small startup in 2013 by independent entrepreneur Christopher Terry and Forex expert Isis De La. Income Tax will arise on deposit interest earned on margin. Finland and Ireland are the second and third in terms of the highest taxes with 34 and.

Spread betting tax-free countries are the UK Northern Ireland Bahamas United Arab Emirates Brunei Monaco Turks and Caicos The British Virgin Islands Oman Vanuatu. This means that for a profitable trader 60 of your gains under Section 1256 will be taxed at a reduced rate. Ad Straight Forward Honest Funding So You Can Focus On Trading.

It has set a number of requirements to forex brokers authorized to. Forex futures and options are 1256 contracts and taxed using the 6040 rule with 60. Profitable trading bot reviewed.

The margin is the initial equity investment which is usually up to 20 to show the investor can complete the contract. Spread betting which is tax-free in the UK and Ireland and contracts for difference CFDs which are available globally. 40 for gains from foreign life.

EToro income will also be subject to Universal Social Charge USC. Avoid The Confusion Maximise Your Tax Back With Our Quick Easy Tax Return Process. How are taxes calculated in forex trading.

And from short-term capital gains 35. Develop a trading plan. Rapid Scaling plan available up to 3M.

This manual sets out guidance on what constitutes trading and includes information from a body of previously decided cases which will assist taxpayers and Revenue. Ad Read before you buy a trading bot. You put up a fraction of the capital and still get the full value of the.

This income will be taxable under normal Income Tax rules. Between 65 and 82 of retail investor accounts lose money when trading CFDs. CGT is 10 for basic rate taxpayers when total income is 12571 to.

He had bought them for 4500. Therefore individuals that are trading in cryptocurrency are required to file an income tax return Form 11 or Form 12 each year and declare profits made on trading. There are other rates which apply to specific types of gains.

Ad Irelands Quickest Easiest Way to Claim Tax Back With Our Simple Tax Return Process. Other tax free or low tax country for forex trading There are essentially 2 areas specified by the internal revenue service that apply to foreign exchange traders area 988 as well as area 1256. Once your main source of income is spread betting then you will be.

If you trade CFDs then you are subject to capital gains tax CGT on gains from your trading activities. Aspiring forex traders might want to consider tax implications before getting started. Capital Gains Tax in Ireland The rate of Capital Gains Tax is 33 for most gains.

The remaining 40 will be taxed as short-term capital gains. Through the forex trading futures the investors will be effectively taxed a maximum of 15 from their long-term capital gains. Guaranteed Funding Payouts.

They are taxed as capital gains at the rate of. Tax on forex trading in ireland. We review trading bots.

For futures traders under the 1256 section 60 of long-term capital gains or losses are taxed at a fixed 15 rate while the 40. Read our trading bot reviews. Tax and Duty Manual Part 02-01-03 5 131 Example 1 John sold crypto-assets for 5000 in 2021.

How Tech Can Help Teach Kids About Money Dislexia Accion Videojuegos

Selling Crypto Do You Pay Taxes On Bitcoin Sales Koinly

Price Vs Value Infographic Trader Oracle Design By Pixlogix Infographic Oracle Design

Selling Crypto Do You Pay Taxes On Bitcoin Sales Koinly

Selling Crypto Do You Pay Taxes On Bitcoin Sales Koinly

Unemployment In Spain Leads To The Creation Of New Currencies Euro Eurotrip Trip

Filing Form 5471 Foreign Corporations Reporting For Us Expats Airbnb Gastgeber Steuererklarung Gelingen

Ireland S Tax Levels Could Be Higher Suggests Esri My Comment What Part Of Enough Do You Guys Not Understand Online Forex Trading American Poker Euro Coins

Discover Your Potential Recruitment Startup Company Funding Options Visit Http Wearessg Com Setting Up A Recruitment Business

Crypto Tax Free Countries 2022 Koinly

Britain S Factory Growth Hits Three Year High Greece Reaches Bailout Deal As It Happened Greece Financial News Growth

Oportunidades De Negocio Estrategia Empresarial Contabilidad Y Finanzas

Pin On Chelsea Burton Core 3 Ireland

Wsj Graphics On Twitter Inversions Allergan Waves

Should You Pay Off Debt Or Invest Money Rebound Investing Money Debt Payoff Forex Trading Basics

Selling Crypto Do You Pay Taxes On Bitcoin Sales Koinly

Company Formation And Business Setup In Dubai Freezones Companies In Dubai Dubai Consulting Business